30+ Minimum payment on credit card

A lender calculates the minimum payment based on the total credit card balance. Eligible minimum monthly spend outside FairPrice.

Googles New Card Style News Drops Local 3 Pack Lower In Search Results Web Design Digital Web Digital River

If the balance is below the flat.

. Best Unsecured Credit Cards. The minimum payment on a 3000 credit card balance is at least 30 plus any fees interest and past-due amounts if applicable. Credit Card Minimum Payments Calculator.

A credit card issued on or after August 1 2019 your minimum payment will be at least 5 of your statement balance. Credit cards with a flat percentage minimum payment usually require 2 to 4 of your balance each month. As a percentage of the amount you owe for instance if youve borrowed 2000 on your card and.

The card issuer may charge a simple flat rate as low as 35 due every month as long as the balance isnt above a certain threshold. Credit card minimum payments are usually calculated based on your monthly balance. A flat percentage of your total outstanding balance.

Taking that into account if your total balance for a credit. Your minimum payment would be 110plus your monthly finance charge20for a total minimum payment of 30. Find a great card for your needs today.

Apply - for All Credit Types. A flat rate. Your monthly minimum payment will be calculated in one of two ways.

Apply for the most rewarding credit card for FairPrice Group spends. If you were late making a payment for the previous billing. If your card has a 21 APR for example your monthly interest rate would be 175 or 21 divided by 12.

Creditors determine your minimum payment by using one of three different methods which include. Your minimum payment is calculated as a small percentage of your total credit card balance or at fixed dollar value whichever is greater. A credit card minimum payment is simply the minimum amount of money you must pay each month to remain current on your debt.

Card issuers generally employ the percentage of balance method for larger balancesmost charge 2 3 on your outstanding balance each billing period. Making only a credit cards minimum payment can greatly extend the time it takes to pay a balance and drive up interest costs. However keep in mind that if you only pay the.

A late payment fee of up to 41. A lenders rule might say. A returned payment fee of.

The minimum payment could be a percentage of your balance plus new interest and. Percent of the Balance Some. Some are not intuitive at all slow to update or otherwise not user friendly.

2 days agoThere are no annual fees with the Ashley Advantage card. Rockhartel 20 hr. Its the 1 way to avoid penalties fees and a revolving balance.

Best of all There are no annual or foreign transaction fees ever. Pay More Than the Minimum. This calculator will show just how much total interest you will pay if you only make the minimum payment required on your credit card balance.

It is either a percentage of the total or a fixed amount depending on your balance threshold. If that person doesnt pay the. Compare rates by card type.

The minimum payment on a credit card is the lowest amount you must pay to avoid paying late charges and damaging your credit score. A typical minimum repayment will be around 1-25 of how much you owe usually including any interest or charges such as late fees or 5-25 whichever is higher. If you have a balance of say.

While making payments on time is great paying them in full is ideal. Compare top balance transfer credit cards easily. Ad Apply for a Top Rated Credit Card in Minutes.

Ad Move high-interest debt to a credit card with a lower rate often 0 for well over a year. Making the minimum payment doesnt do. Cards issued before August 1 2019 will eventually adapt.

425 30 votes. If your credit card balance is. But it can make senseoccasionally.

If you pay the balance to zero there shouldnt be any issues fee anyway though. Multiply that by the balance youre carrying. The minimum payment on your credit card statement is the smallest dollar amount you must pay in a given month.

However two penalty fees are attached to the card. All Credit Types Accepted.

Get Free 20 Turn Your 40 Into 60 In Seconds Prepaid Debit Cards Visa Debit Card Budget Saving

Credit Card Debt Statistics For 2022 The Ascent

How To Get Out Of Debt Fast The Science Backed Way Student Loans Refinance Student Loans Student

Volume Trading Strategy Win 77 Of Trades Trading Strategies Options Trading Strategies Trade Finance

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

2s Pvsqj3oln2m

Minimum Viable Product What Is A Mvp And Why Is It Important Roadmap Technology Roadmap What Is A Product

Home Finance Printables The Harmonized House Project Free Printable Labels Templates Label Design Finance Printables Credit Card Debt Worksheet Budgeting

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy Budget Planner Printable Money Planner Budget Planner

Risk Management And Risk Reward Ratio Rules Risk Reward Risk Management Technical Analysis Charts

Business Loan Business Loans Membership Card Loan

Student S Personal Finance Basics Personal Finance Infographic Finance Infographic Personal Finance

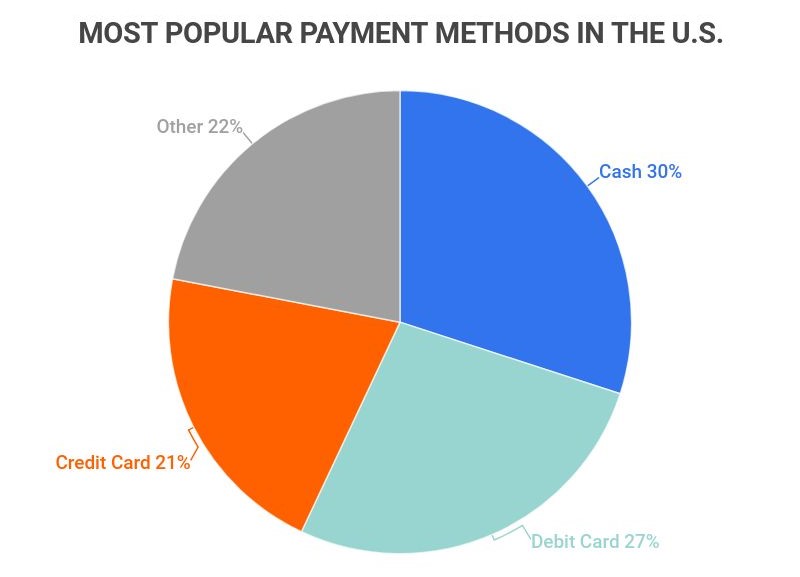

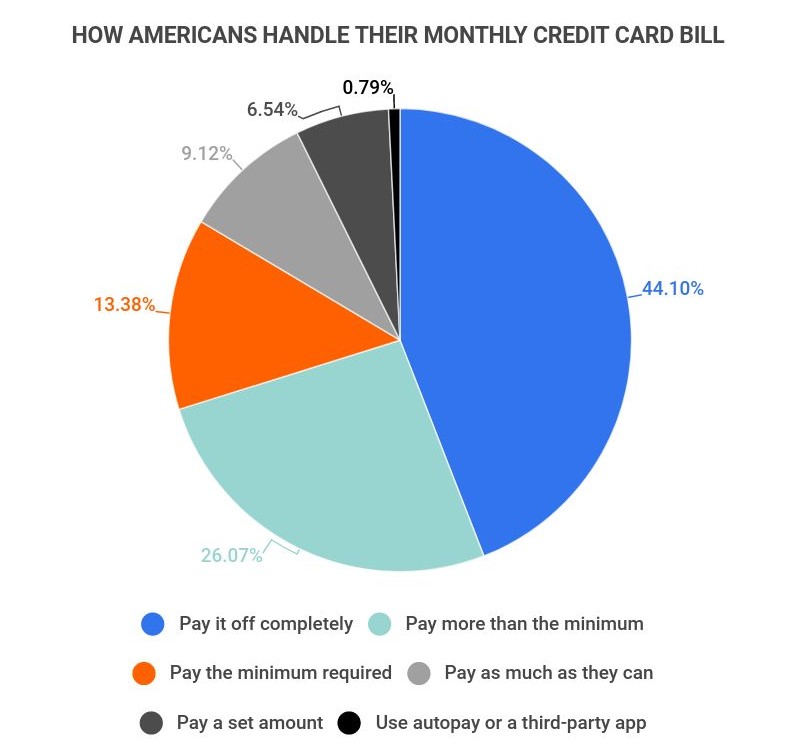

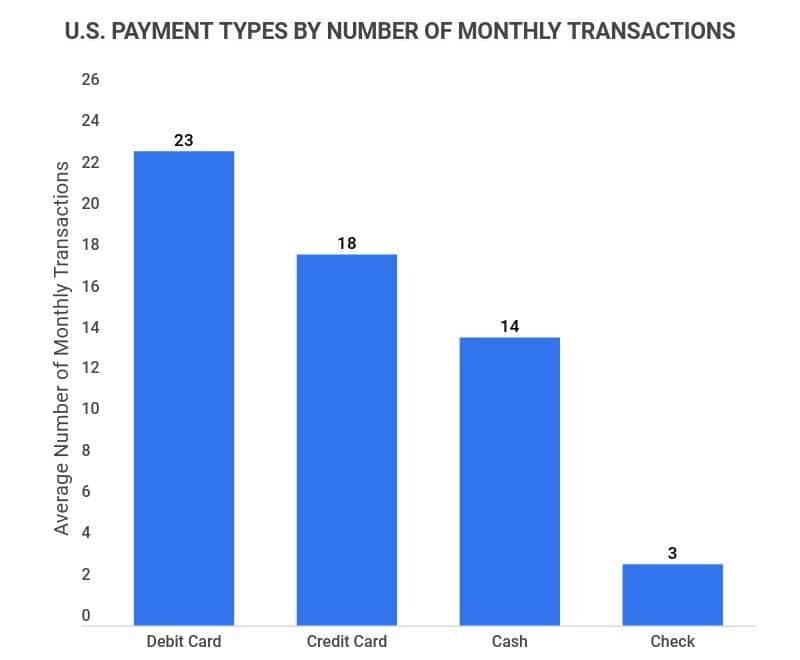

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

Graphic Design Work Order Form Example Download This Graphic Design Work Order Form Example Template And After Downl Graphic Design Jobs Order Form Templates

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

30 Credit Card Statistics 2022 Credit Card Debt Fraud Usage And Ownership Facts Zippia

How We Eat Out While On A Tight Budget Best Money Saving Tips Money Saving Meals Saving Money